By Clare Flynn Levy

Share post

In the last year, Artificial Intelligence (AI) has gone from the purview of science fiction movies to something that appears almost daily in our newsfeeds. Commentators display almost an almost religious zeal in predicting the changes that will be brought about by this latest technological leapfrog.

This is not something to which investment management is immune, with techno-optimists confidently asserting that even the most successful fund managers will find themselves replaced by omnipotent robots.

But if we take a more scientific look at how AI is actually applied to decision-making, the evidence suggests a continuum of technological sophistication, rather than a binary switch.

In fact, far from an existential risk, the version of AI that is slowly taking hold in investment management actually offers opportunities for human fund managers to develop their capabilities and cement their position in the investment process.

AI’s different guises

Colloquially, the term artificial intelligence, first coined in 1956, is increasingly being applied to any situation where a computer can simulate cognitive behavior that is normally associated with humans, be that learning, analysis or problem-solving.

As a label, however, AI is actually a blunt tool when used to describe accurately how far technology’s intelligent capabilities extend practically into different sectors and fields.

A more useful framework for measuring this can be found in the work of PwC’s Anand Rao. Rather than as a single standard, Rao presents AI as a continuum which ranges from Assisted Intelligence through to Autonomous Intelligence:

- Assisted intelligence: Computers take on automation of existing processes, including the replacement of repetitive and standardized tasks previously done by humans.

- Augmented intelligence: Where humans and technology learn from each other, empowering humans to do things they couldn’t do before.

- Autonomous intelligence: Computers make all the decisions and can program themselves.

Could do better

Where does investment management sit on this AI continuum?

Given how much data is involved in every aspect of the asset management business, there is easily enough information available for multiple forms of AI to be possible.

Fund management firms should already be exploring how they can use technology to reduce the number of decisions that rely on human judgement down to just the ones where human judgement is actually a competitive advantage.

On dealing desks, we’ve seen the emergence of augmented intelligence through smart order routing and algorithmic execution. But when it comes to the pre-trade investment process, use of AI is stuck largely on the left hand side of the spectrum – assisted intelligence – with little real advance on the automation achieved originally by Microsoft Excel.

This may not be a surprise. As someone who was in the thick of the internet bubble of the late 90s, I can tell you that even if technological progress is fast (and getting exponentially faster), human adoption of it often isn’t.

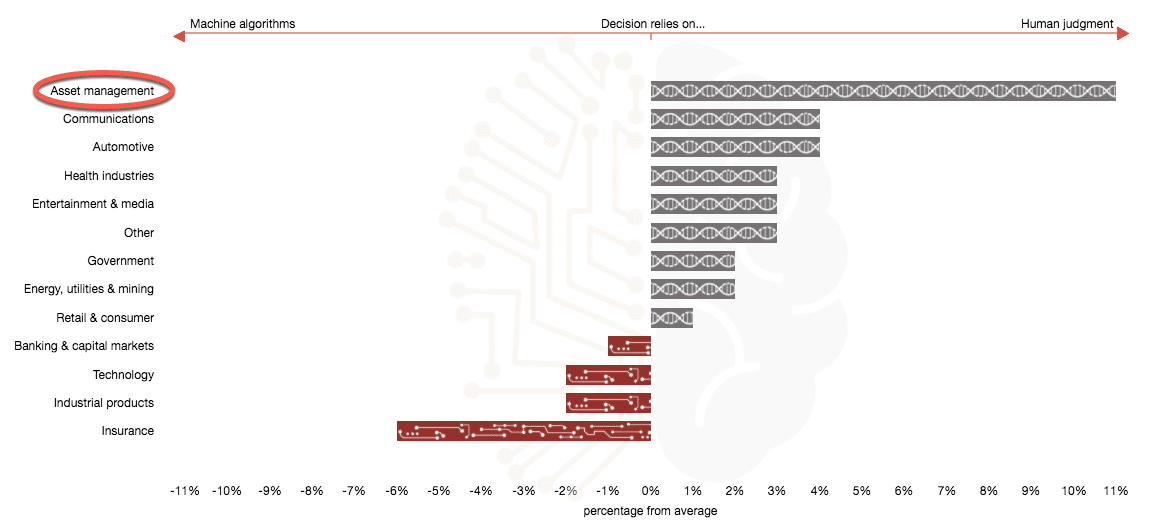

The investment management sector is known for being especially conservative and slow to adopt new technology. Indeed, in PwC’s 2016 Data & Analytics Survey of over 2,000 senior executives, the Asset Management industry stuck out like a sore thumb in its reliance on human judgement in decision-making:

Source: PWC Global Data & Analytics Survey 2016

Time to change

This dependence upon humans, with processes and tools that have changed very little in the last 20 years, is one large reason why many are concerned about the active fund management industry’s ability to compete with lower-cost computer-driven alternatives or with new competition from data giants such as Google.

But this context doesn’t mean that active fund managers can’t compete. Rather, it means they have no choice except to compete, and to do so more effectively. As a matter of survival, investment management firms need to embrace technology as a partner and move toward the centre of the AI continuum.

What’s possible?

People who predict that autonomous intelligence solutions (machines that can program themselves) will replace human fund managers in the foreseeable future are overshooting.

Certainly, successful autonomous intelligence solutions do exist. But they work best in completing tasks that exist in structured environments where all relevant information can be considered and where there is a knowable set of outcomes. For example, most of the chatbots emerging today are aimed at this type of task: scheduling meetings, ordering food, playing games and the like.

By contrast, AI experts are the first to explain the limitations that exist for technology in investment management and other areas of complex decision-making. Even at its most advanced, the technology still requires human intervention in some form – either as a final decision or in the creation and modification of the algorithm.

The future of active management is augmented intelligence.

Technology needs you

Augmented intelligence helps humans to do things they couldn’t do easily before.

An example of the augmented intelligence at work in investment is nicely encapsulated by David Zweig’s recent article, How to Be Your Own Quant. Zweig relays how UBS was unable, despite its best efforts, to develop computer models that could beat the skill of their own human analysts in creating successful earnings forecasts.

However, by reframing the situation from one of competition between man and machine to one of co-operation, they saw the chance to use technology to help counter a very human frailty: inconsistency – (Zweig observes that “Human judgment is inconsistent. People are good at knowing what matters, but not very good at always looking at it the same way”).

UBS therefore developed an augmented intelligence approach through which human analysts are involved in advising the quant team on which earnings variables are the most useful, and the quant team then incorporates them into the model, improving the overall consistency and performance of the forecasts.

This combination is a win-win for both humans and technologists. In it, we see the kind of synergy between human and computer that is a key feature of augmented intelligence. As Zweig summarises in his article, augmented intelligence allows you to “…couple your human judgement about what works with a computer-like discipline of applying it.”

What are you waiting for?

There’s one fact that today’s investment managers can be sure of: the number of human portfolio managers is not likely to grow from here – indeed, some are predicting that the world will have one-third fewer PMs in five years’ time.

In order to compete, PMs don’t necessarily need to change their investment processes, but they do need to update the role that technology plays.

The first step in applying augmented intelligence to your investment process should be to use technology to look in the mirror and ask yourself which aspects of your decision-making have added and destroyed the most value in the past, and in what contexts? What questions do you wish you could answer, with zero effort on your part, about what works and what doesn’t?

This is what Essentia clients are able to do, via the intelligent technology and analysis-driven feedback that’s provided to support clients using our Insight service.

In addition, when Essentia sends one of its clients an automated nudge (for example when a position looks vulnerable to a behavioral bias that’s been damaging in the past), it’s the PM who makes the decision about whether to act or not – not the computer. In a proven partnership between man and machine, the computer acts as a sort of “wingman” in the investment process, providing an objective, data-driven feedback loop that a human would simply not be able to produce on his or her own.

Beyond the hype, and despite the portrayal of AI as the “enemy” of human investors, the reality is that AI – in the form of augmented intelligence – is fast becoming the secret weapon of enlightened human portfolio managers. Assisted by technology, they can generate measurably more alpha by focusing their own energy on what they do best, and leaving computers to do the rest.

This article originally appeared on Forbes.com in July 2017.